How Much Money Do You Need To Retire Comfortably

Design Your Future

Simple Guidelines For Early Retirement

How much money do you need to retire comfortably?

One of the key questions people asked.

Some people plan to retire early in their 40’s and some people hustle to retire in their 50’s, while others work well into their 60s and 70s before leaving full-time work for good.

If you’ve been working hard, don’t be surprised if one day you find yourself remain at work in your senior years…

My husband and I used to borrow our lifestyle when we were living in New York.

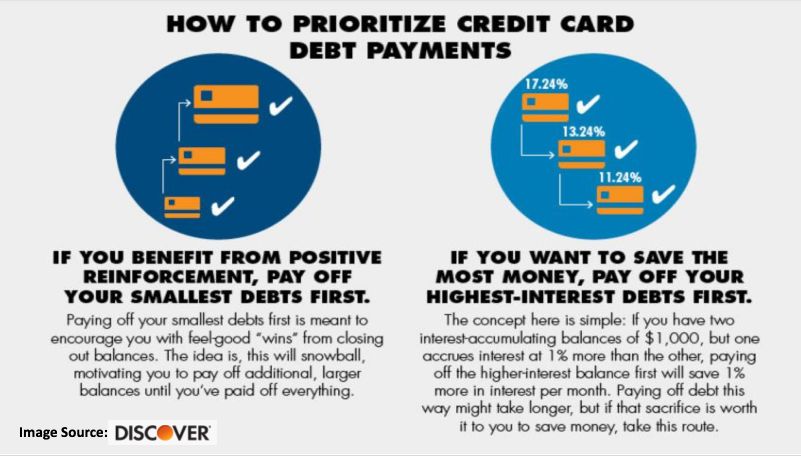

During those years, US$17,000 in credit card debt is a lot of money especially when you are living paycheck to paycheck.

Whether you owe $1,000 or $100,000, any amount of debt will severely stress your savings once you retire.

Today, I will share with you some of the steps I made – my retirement roadmap to end my uncertainties.

Live A Life You Deserve...

Each and every one of us, we have fixed expenses that can’t be avoided…

It’s impossible to avoid paying house rental; credit cards and, in many cases, car loans.

And expenses that we can avoid…eating outside, shopping, and traveling.

The question that should be answered is what the spending limit should you allocate in each of your spending categories?

One biggest decision my husband and I made in our lifetime was…

When we decided to give up our career in NYC and start a new life in the Philippines in1996.

I remember clearly that we do not have anything under our name.

We do not have any knowledge of how to handle money better.

It was a nightmare living with uncertainties.

Tips How To Keep Yourself Out Of Debt

- Prioritize paying off debt

- Don't borrow more than you expect to make

- Avoid "buy now" and "pay later" attitude

- Practice delay gratification

- Pay with cash whenever possible

- Live within your means

- Always pay more than the minimum payment

- Take only the cash with you that you can afford to spend

- Avoid borrowing your lifestyle

- Keep a record of all your purchases

According to Discover Credit Resource – “The average American household owes more than $7,000 in credit card debt”.

When we reached the Philippines, we borrow from relatives to make ends meet.

And by the time we got our new job…

We made a commitment to pay off all our debts in two years…

Cut all the credit cards in our keeping and finally become debt free in two years.

We made a lot of sacrifices, work very hard, and we learn the skill of delayed gratification.

It was not easy…

But with all the discipline and determination – it’s really worth it!

After two decades, we didn’t expect to drop our daughter attending her university in New York…

Living Within Your Means

If you are living paycheck to paycheck, retiring early won’t make things easier.

Ric Edelman, the chairman and co-founder of Edelman Financial Services, LLC, and author of several personal finance books said, “Once you show people how money works, they almost instantaneously change their behaviors.”

Several years ago, I do NOT care about anything to secure my future.

I spend money without any control, no savings, borrowing my lifestyle, and I don’t know what I’m doing is totally bad for me.

Here’s the thing: There’s more to retirement than just having enough money to pay current bills or just having the appropriate amount saved.

You have to consider your long-term health care needs, as well as any inheritances you’d want to leave behind for your loved ones.

Why You Need To Have An Emergency Fund?

Life often gives us unexpected money problems. That’s why it’s so important to have money set aside.

There are several unexpected expenses, whether just got fired, or a sudden illness.

The emergency fund comes into play when life throws you a major curveball, you have money to fall back on.

You’ll use this money for any unexpected events.

There was a time in my life when I believed if you worked hard and did your job well – your job was safe forever.

But…

I was completely wrong. I worked for a company where at one time everyone was “family”. Something happened and I felt this time it would be different. I began to see where the employees stood.

So by the time, my husband and I made our 2nd major decisions to quit our full-time job together in 2012, we have money to fall back on.

How Much Should I Save For Emergency Fund?

That all depends on you.

Know your household monthly fixed expenses.

How much do you allocate for a rainy day fund?

Rainy day fund is the money you pay for things without using your credit card.

Like you’re going to need a few hundred dollars that you can easily access. When you need it, it’s there.

EXAMPLES:

- Car repair

- Plumbing service

- Sudden visit to the dentist

So it is important that you have a realistic number in mind.

Is your monthly spending $1,500 or maybe $3,000? Whatever the amount for your monthly expenses is, multiply it by six.

That’s how much you should try to put away & that’s how it can guide you how much money do you need to retire comfortably.

Never Rely On Social Security During Retirement

Social Security is the major source of income for most of the elderly.

But…

If you want to retire comfortably, social security should be your last resort.

The average monthly retirement benefit under the old-age and survivors insurance was $1,436, according to the Social Security Administration – April 2020.

Retired workers received an average of $1,510 while spouses of retired workers received $786 and children of retired workers received $715.

Unfortunately, living a life that you deserve can be difficult if you don’t take charge of your own finances.

Why Need Retirement Planning?

How can you retire comfortably if you don’t even know how did you spend your money.

I bet most of you reading this, you do not know how much you spent last month right?

If you don’t know this number how would you know how much you needed to have the kind of lifestyle you want in the future?

Learn how to monitor the in and out of your money.

I personally do not use any sophisticated retirement savings calculator, but this simple excel worksheets, help me a lot if I’m entitled to get a vacation or work more harder to grow my business.

You can download below for FREE.

The Importance Of Financial Planning

If you don’t have financial planning that means you’ve got higher financial risks in your senior years.

Retiring comfortably means you have to plan it in advance.

Imagine trusting all your savings with your fund manager into a high-risk mutual fund?

And you are anticipating a high return and losing a major chunk of your hard-earned money.

By the time you reach your retirement age, you simply wiped out all your savings.

What would you do?

Financial planning reduces the risks of loss by trusting someone with your hard-earned money.

Creating impulsive decisions due to time constraints is very dangerous and risky.

Don’t do this.

This photo was taken in Atlanta, Georgia in June 2019.

Earn More To Invest More With Certainty

I’ve lost a lot of money trading options and stocks.

When I was still working in Thailand as an ex-pat, I’ve got this book about investing.

To make my story short, I followed everything that this book teaches me and made a promise to myself that I want to meet the author of this book and wanted to learn from him when the right time comes…

And after 7 years of working and growing my business from home, in June 2019, I flew to Atlanta, Georgia. Now, I’m ready to learn more about investing with certainty – buying companies that are wonderful.

Melissa and Phil are such a good host and they also welcome me and my daughter to visit their ranch.

Steps How To Create Your Financial Planning

- Set your retirement goal (based on the lifestyle you want)

- Monitor your money and work towards your goal

- Pay off all your debts

- Never have a ceiling of your income

- Save more than you spend

- Invest with certainty

- Let your money work hard for you

How To Create A Retirement Roadmap to End Money Uncertainty

Uncertainty is all around us. From job security, finances, physical and emotional.

We’re all different in how we handle and tolerate uncertainties in life.

Some people can take risks and some cannot.

If you agonize over preparing your retirement, focus first on controlling those things that are under your control – like monitoring your money, and challenge yourself on how you can generate more income by using your experience and turn it into a resource.

Independent consultancy is becoming a popular business startup.

When I left my highly successful job as an ex-pat executive & began my consulting business startup…

I purposely didn’t start with a complex business plan.

Because I knew that I would only get a sense of real income once I tested my business idea in the marketplace.

And not on paper for me to see if someone will pay me.

I focused on simplicity & the practicality on how to get my first consulting client.

So I started learning how to make a living from home.

I started to take charge of my future right after I decided to pay off my debt.

Retiring early takes time and incredible discipline.

The journey to retirement is NOT easy but if you do all your preparations – to earn, save, and invest as much as you possibly can, it can give you all the flexibility and the life you ever wanted.

To work travel, and relax on your own schedule.

Conclusion

Everyone’s retirement income needs will be slightly different.

To calculate how much money do you need to retire, you need to carefully calculate your anticipated expenses and potential income streams.

Know your retirement numbers (the lifestyle you want) and work towards your goal.

Setting goals, creating an action plan for achieving them, and reviewing it regularly throughout your journey can help keep your finances and retirement years secure.

If you’re retired or nearing retirement, it’s important to keep your goals firmly solid.

Hopefully, this guide has taught you on how to prepare your retirement and give you a clear guide how you can calculate how much money you need to retire comfortably.

Create your own rule and own your outcomes!

Go to design your future!